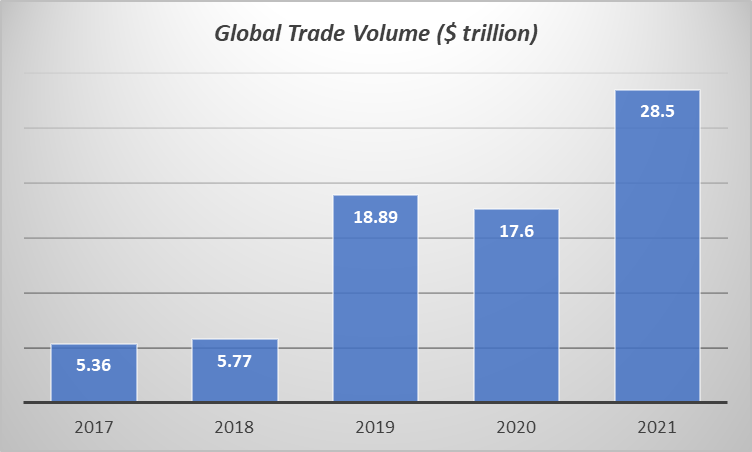

The emerging global economy and spread in information and communications technology have raised production, trade, capital flows and e-commerce to hitherto unknown levels. As of 2021, global trade grossed over US$25 trillion, a 38% increase when compared to the previous year. With all the positives, however, the global economy, still experiencing the aftermath of the Coronavirus pandemic and currently, Russia’s invasion of Ukraine, is facing an increasingly gloomy and uncertain outlook.

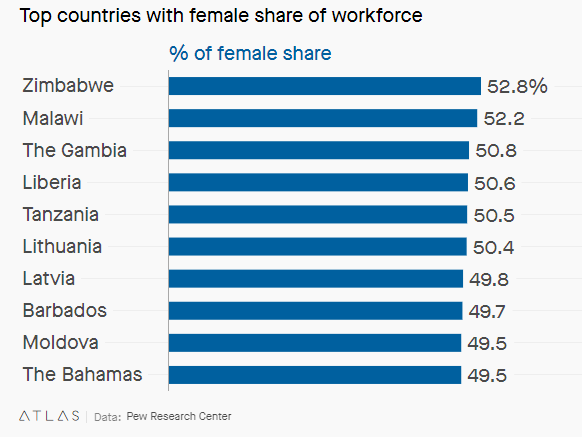

With a widened economic and social inequalities within countries,there is worsened human vulnerability and insecurities which has changed the nature of jobs and work- the outcome, millions of people thrust into the ranks of the unemployed and the poor. A disproportionate number of these are women.

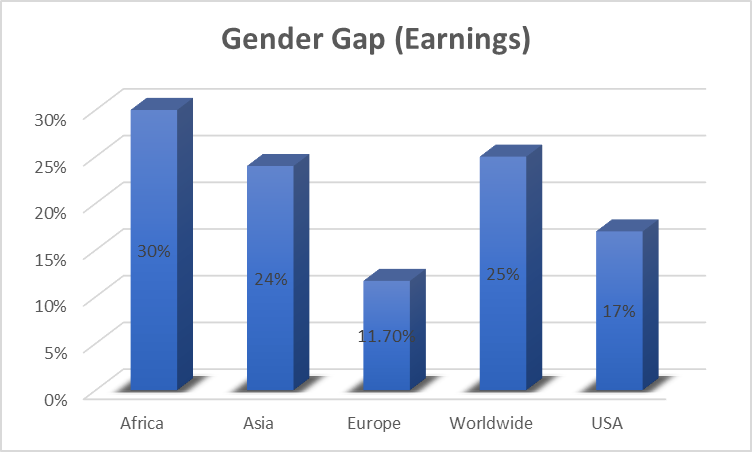

Globally, about 2.4 billion women of working age are not afforded equal economic opportunity and 178 countries maintain legal barriers that prevent their full economic participation. To put in a clearer perspective, the gap between men’s and women’s expected lifetime earnings globally is US$172 trillion – nearly two times the world’s annual GDP.

One billion women –more than 40% of the women around the world – still don’t have access to financial services, despite women’s growing share of global consumer spending. Having a safe place to keep and save money, obtain credit, insurance, pension or other financial services can enable financially excluded one billion women from around the world to gain better control over their lives and improve the lives of those around them.

In Africa, the gender gap in access to financial services is driven by women entrepreneurs’ own self-perception. In sub-Saharan Africa, only 37 percent of women have a bank account, compared with 48 percent of men, a gap that has only widened over the past several years. The figures are even worse in North Africa, where about two-thirds of the adult population remains unbanked and the gender gap for access to finance is 18 percent.

These gaps therefore raise urgent questions for decision makers in Africa. What continues to fuel gender disparity in access to finance across the continent and most especially, Africa?

Way Forward: A Case Study of Women Empowerment by Grooming Centre

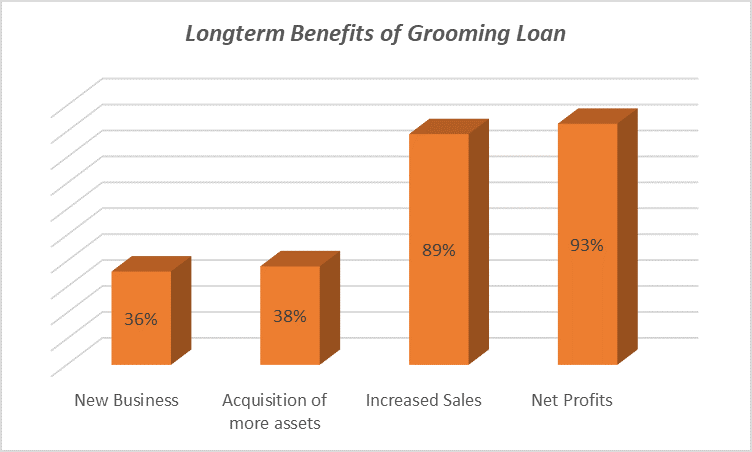

Over the years, accessing credit facilities by MSMEs in Nigeria has proven to be a difficult task due to the high interest rates and lack of collaterals which discouraged businesses mostespecially women entrepreneurs from applying for loans.

Considering the potential multiplier effect of an empowered woman, Grooming Centre has in the last 16 years been championing the improvement in the lives of grass-root but economically active women nationwide.

As the first Microfinance Institution in Africa, the organization has provided credit facilities to over 600,000 women entrepreneurs nationwide.According to a “2017 Social and Economic Impact Assessment” of Grooming Centre’s credit scheme, findings revealed that 93% of the women experienced 93% of net profits in their businesses.

It is however important to state that women contribute a large amount to a country’s GDP. As stated by IMF, full engagement of women in Nigeria could add as much as 23% to her GDP.

Hence, there is every need to empower Nigerian women particularly in the present global economy which recognizes the need for individuals to develop their potentials and contribute to the overall development of the nation.

Giving women greater economic empowerment means enabling women to increase their right to economic resources and their control over meaningful decisions that benefit themselves, their households and their communities.

It is therefore expedient that Government at all levels; private organizations and private individuals participate actively in empowering women at all levels of the society.

You can reach out to the Center for Research in Enterprise and Action in Management – CREM to measure the impact of your organization’s programmes.