PREMISE

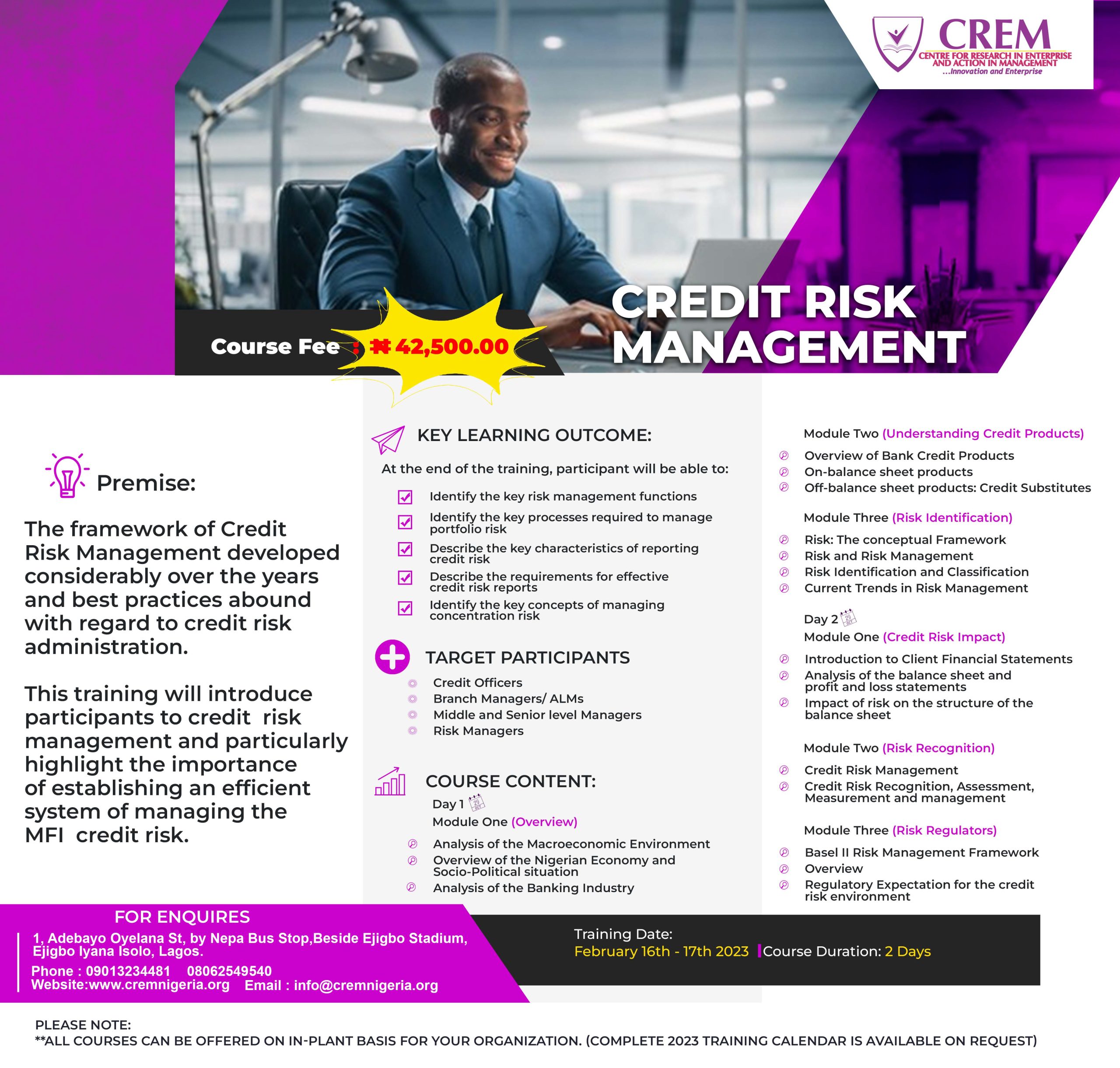

The framework of Credit Risk Management developed considerably over the years and best practices abound with regard to credit risk administration. This training will introduce participants to credit risk management and particularly highlight the importance of establishing an efficient system of managing the MFI credit risk. Focusing on middle management will allow the knowledge and skills gained to percolate downward to subordinates

KEY LEARNING OUTCOME:

At the end of this training, participants will be able to:

- Identify the key risk management functions

- Identify the key processes required to manage portfolio risk

- Describe the key characteristics of reporting credit risk

- Describe the requirements for effective credit risk reports

- Identify the key concepts of managing concentration risk

TARGET AUDIENCE

- Credit Officers

- Branch Managers/ ALM

- Middle and Senior level Managers

- Risk Managers

COURSE CONTENT

Day 1

Module One

- Analysis of the Macroeconomic Environment

- Overview of the Nigerian Economy and Socio-Political situation

- Analysis of the Banking Industry

Module Two

- Overview of Bank Credit Products

- On-balance sheet products

- Off-balance sheet products: Credit Substitutes

Module Three

- Risk: The conceptual Framework

- Risk and Risk Management

- Risk Identification and Classification

- Current Trends in Risk Management

Day2

Module Four

- Introduction to Client Financial Statements

- Analysis of the balance sheet and profit and loss statements

- Impact of risk on the structure of the balance sheet

Module Five

- Credit Risk Management

- Credit Risk Recognition, Assessment, Measurement and management

Module Six

- Basel II Risk Management Framework

- Overview

- Regulatory Expectation for the credit risk environment

COURSE DURATION: 2 Days (February 16th -17th) 2023

COURSE FEE: N 42,500.00