What you need to know about bank recapitalization

The Central Bank of Nigeria (CBN) recently announced an upward review of the capital requirements for the operations of commercial, merchant and non-interest banks in the country. This is coming on the heels of Naira depreciation amidst domestic and global shocks.

With this directive, commercial banks with international authorisation are expected to increase their capital base to N500bn and national banks to N200bn while those with regional authorisation were expected to achieve a N50bn capital floor. Similarly, non-interest banks with national and regional authorisations will need to increase their capital to N20bn and N10bn, respectively.

In retrospect, recapitalization of banks in Nigeria was last carried out about 20 years ago when banks increased their capital base to N25bn. At the time, 89 money deposit banks got reduced to 25 as a result of mergers and acquisitions while some had to downgrade their operational licenses.

So, what does recapitalization entail in the banking industry?

Recapitalisation in the banking sector programme is a regulatory initiative of the CBN that requires banks to increase their minimum paid-in common equity capital to a specified amount according to their license category within two years. Banks are also given the option to downgrade the scope of their activities in exchange for lower capital requirements.

The overall aim of the recapitalisation is to ensure that Nigerian banks have the capacity to take bigger risks and stay afloat in times of trouble, support different sectors of the economy, and improve confidence in the banking system.

Nigerian Banks and their Soundness

The Central Bank of Nigeria reports confirm that Nigerian banks have good soundness indicators. As of January 2024, the industry Capital Adequacy Ratio was 13.7%, above the prudential threshold of 10%. The Non-Performing Loans as a ratio of total loan assets was 4.81% against the prudential threshold of 5%, which is also positive. A liquidity ratio of 40.14 against the prudential minimum of 30% also reflects a healthy position.

The summary is that based on the financial soundness metrics, Nigeria banks are adjudged to be generally healthy. However, this does not diminish the need for regulatory authority to ensure that this soundness and stability are preserved and improved, especially because of the recent macroeconomic headwinds. This, perhaps, is what informed the current policy of the CBN to review the capital base.

Read: Floating of the Nigeria Naira

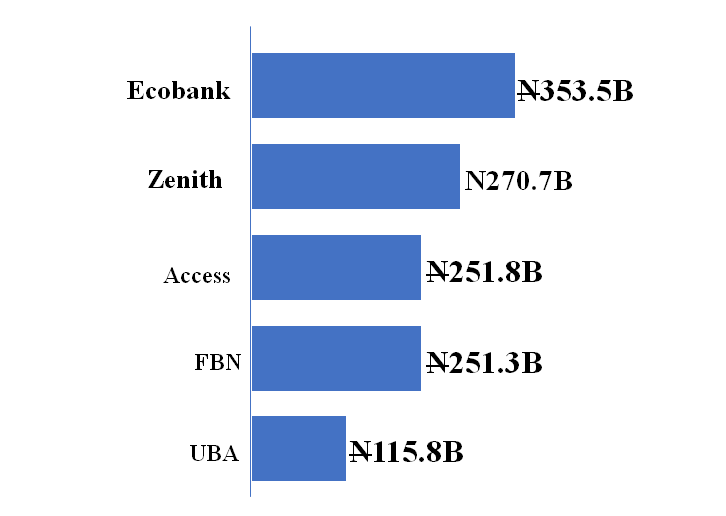

Tier 1 Banks Current Capital

According to 2022 Banks Audited Financial Statements, Ecobank had the highest capital amount among tier 1 banks close to N400B and United Bank for Africa (UBA) having the least capital at N115B. This data intuitively indicates that Ecobank will need about N147B while UBA a staggering N385B. On an average, Tier 1 banks will need N250B to meet the minimum capital requirement for recapitalization.

Implications

Banks

Recapitalisation means increased liquidity in the banking sector which could lower lending rates in the medium to long term. Consequently, banks having stronger ability to absorb loan losses and withstand economic shocks.

Secondly, a larger capital base will enable banks to underwrite bigger levels of credit in the economy and ultimately generate higher income. The new single obligor limit based on the new capital will enable banks to finance larger ticket transactions.

Economy of Scale

The Tier-1 banks control over 70 percent of total assets and revenue in the sector. This implies that scale has a major role to play in this space. The recapitalisation will reposition the banks to be more efficient, resulting in increased capacity.

On the Economy

Looking at the implication for the economy, a stronger financial system will provide great support for the Nigerian economy as it works towards evolving into a $1.0tn economy in 2030.

Similarly, there will be increased FX liquidity in the economy and ultimately support naira stability given the estimated required additional capital for banks (N3.3tn). Banks will have to attract foreign portfolio & direct investors to invest in the capital raise.

Increase in business activities: To deliver value to shareholders, the banks will need to expand their business activities, especially lending in the medium to long term. “We hope this will impact the SMEs space, which has enjoyed minimal support from the commercial banks.

Conclusion

Given the requirement to use only paid-up share capital and share premium for recapitalisation, the majority of banks will turn to the stock market to secure extra funds, either via subscription offers or rights issues.

With this, the market deepens, increase equities market capitalisation as well as serve as a veritable source of foreign direct investment (FDI) with positive multiplier effects on the economy.

Read: How to Survive Inflation in Nigeria